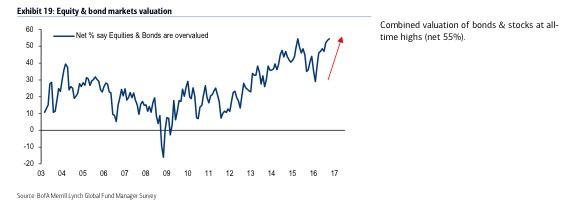

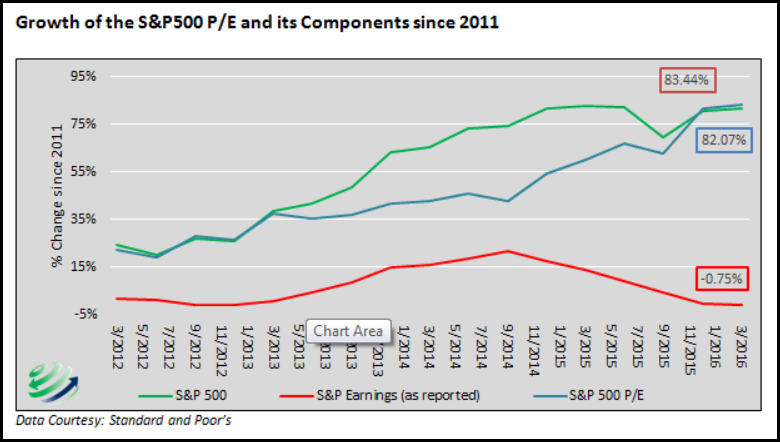

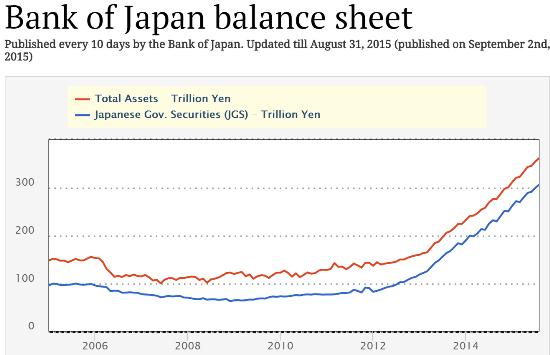

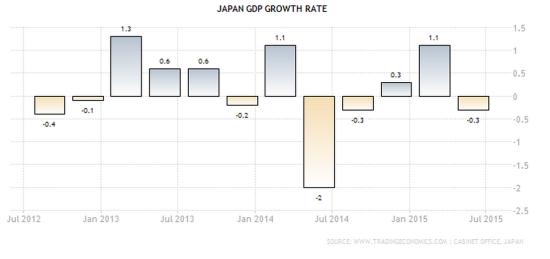

There's loads of things to worry about if you are a bear such as valuations, China, US yield curve flattening, economic woes in Europe, the recent collapse in freight rates etc. Here is an apt summary of these views from the pro's:

Things to Worry About as a Bear

First Western Financial (MYFW) to Release Quarterly Earnings on Thursday

-

First Western Financial (NASDAQ:MYFW – Get Free Report) is scheduled to be

issuing its quarterly earnings data after the market closes on Thursday,

April 1...

8 minutes ago